English Farming and Covid-19 Update – January 2021

Welcome to this quarter’s Farming Update, which is produced by our Farming Research Group and reports on market and administrative issues that affect farmers’ business decisions and on which they may need to act.

MARKET UPDATE

Sources

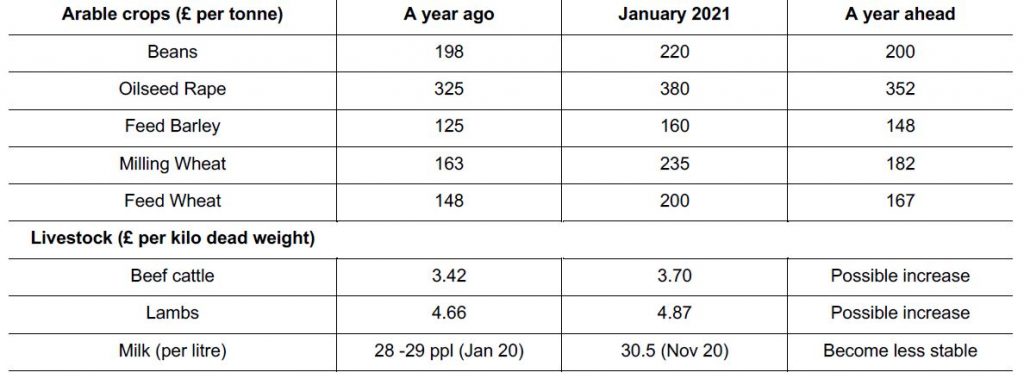

Arable crops: AHDB & FW. Prices are ex farm. Future prices are indicative bids from agricultural traders. Livestock: FW. Beef R4L steers and lamb R3L specification. Future prices from outlook reports. Milk: DEFRA

ARABLE CROPS

Global: Grain Production Report

Global grain production in 2020/21 is predicted to increase by 33

million Tonnes on last year, this is with record crops expected of

wheat and barley. (International Grains Council).

Globally wheat prices surged last year despite record production

and global stocks ending up at a record high. The USDA reports

that the high prices appear to be led by China and India who have

been building up larger government stocks, and in China in

particular, as they currently hold more than a years’ worth of the

nation’s consumption of wheat in stock. However, this next year is

expected to see reductions in global supplies, as higher

consumption, particularly in China and India will outweigh a record

year of wheat production (USDA).

In addition, news that Russia is about to increase its wheat export tax has also supported wheat markets during January

Dry conditions in the USA and Russia during the autumn when new crop wheat was being drilled has strengthened prices for new crop wheat. (USDA)

Soybeans

Soybean production is also set for a record year globally, driven by a larger area of the crop in the USA, and an improvement in the South American crop’s productivity from last year. This increased supply is set to be more than matched by China’s recovering pig herd (after African Swine Fever’s decimating effect) which will be requiring more protein. (International Grains Council)

UK MARKET

Wheat

Old crop feed wheat is currently trading at over £200/T (milling wheat is achieving up to £238/T) having risen sharply during December and January (AHDB). Stocks in the UK are low owing to the smallest harvest since 1981 according to DEFRA’s revised harvest estimate published in December. This put the 2020 wheat harvest at 9.66 million tonnes (40.5% lower than in 2019) with an average yield of 7.0 Tonnes/ha along with a reduced crop area. The limited stocks are causing the UK price to track the global values, which appear well supported.

New crop wheat futures at this time of year for the following November are currently at the highest point in the last seven years, at £168/T, which equates to an ex-farm price of around £160/T for feed wheat, November movement. The UK-EU trade deal being signed at the last minute caused a lot of uncertainty towards the end of the year, but the announcement that there are no tariffs for wheat being exported to the EU is welcome news for 2021 when the UK expects to return to being a net exporter of wheat again. Having to chase non-EU trade for the UK exports would have had an impact on UK farm gate prices.

Barley

Malting barley demand and thus prices are still suffering as

brewers struggle to shift products in a locked-down world. There is

little trade happening here as a result. With news of the

coronavirus vaccine being rolled out brewers may begin to predict

an opened up society which they feel they can forward buy barley

for soon, and with the Brexit trade deal in place the EU is again a

market for the UK malting barley grower.

The feed barley price remains at an enormous price difference to feed wheat, of over £50/T, putting feed barley at around £150/T for February movement. Barley was being pushed through the ports in late 2020 as the UK’s surplus was rushing to be exported before Brexit (in case no trade deal was agreed as this would have seen tariffs applied to exports to the EU). The log-jam has now become less pressured and will smooth out through the spring, this might support prices a little as farmers no longer feel the need to be rid of it so quickly. Prices could also be supported by the Russian export tariff which will be applied from mid-February, which will increase the price charged by one of the UK’s export competitors.

Oilseed Rape

The UK’s Oilseed rape story has faded from the headlines recently – however prices are strong for this crop at the moment and appear to be well supported by strong prices globally for soybeans and other oilseeds.

The ban on neonicotinoid seed dressings means that many farmers are growing smaller acreages or have abandoned the crop altogether, as they simply cannot stop the crops being eaten by Cabbage Stem Flea Beetle. The AHDB early bird survey reports that plantings for the 2021 harvest have reduced again, for the third consecutive year: 18% lower than the 2020 harvest area. This suggests that those who have found a way of growing the crop will benefit from strong prices when they come to sell, as the UK will be importing ever larger amounts to make up the shortfall.

LIVESTOCK

Regenuary and Veganuary

Veganuary has some competition on the block – Regenuary. With the subject of Regenerative Agriculture grabbing the attention of people on both sides of the farm gate Glen Burrows (co-founder of the ethical butcher) has found a way to push it further into the limelight. The public awareness of environmental and welfare standards being laid bare by the furore of the American chlorinated chicken debacle shows that movements such as Regenerative Farming will create quite an attractive proposition to UK consumers. Where Veganuray started in terms of increasing awareness for animal welfare and environmental impacts of food consumption Regenerative farming may finish in mopping up all those who care about those issues but are unwilling to give up meat and dairy in their diets, as reported in the Farmers Guardian.

Beef and cattle

The first exports of UK beef to the USA in over 20 years made their way onto American plates in the autumn from Northern Ireland. Secretary of State for International Trade Liz Truss’ department estimates this new flow may be worth up to £66 million over the next 5 years. This came a year after the UK beef to China trade opened up again after a similarly long period. It appears the mantle of the BSE outbreak has finally been lifted form the UK beef industry, and it also shows how long it can take to undo the damage from disease control failures.

With the Brexit trade deal signed the EU market for UK beef remains open too. In the context of the positive trade outlook for beef the UK prime cattle deadweight average price is well above the 5-year average at 370.5p/kg on 6th January (AHDB).

Lambs and sheep

Lamb prices remain supported and are well above their 5-year average too at 487p/kg deadweight (AHDB). The Brexit deal and a drought in New Zealand (reducing lamb production there) will provide further support to the UK sheep industry. The sheep farmers in the UK had weathered quite a storm of uncertainty, but the regular lockdowns and hence high home cooking demand for lamb mince and roasting joints have made 2020 a good year in terms of lamb sales and there appear to be blue skies on the horizon (or red skies at night) as we go into the lambing season.

Dairy

UK dairy production hit a 25 year high in November (FarmingUK) this was against a picture of uncertainty about a trade deal and a shrinking Dairy herd (down 2.8% on last year in cow numbers). The shrinking UK herd at such a rate is thought to be the effect of low calving numbers in 2016-2017, since then there has been an increase in heifer calves born – thought to be a knock on from the increased use and efficiency of sexed semen being used on farms. It appears the average cow’s milk yield is rising to make up for the falling herd numbers.

The status of the UK as a “Third County” in relation to exports to the EU may cause some disruption to the fresh milk market here. Historically the milk industry has been able to send excess fresh milk to the continent, but this process needs to be able to be at short notice and have a quick turnaround. In the new trading conditions each load of fresh milk will need to apply for an EHC (export health certificate) before being exported, this will add time and cost to the process. A build-up of excess fresh milk might create a very variable milk price at the farm gate while the milk processors adapt to the changes.

Arla has introduced a new scheme called ECHAV – Every Calf Has A Value. In response to greater public awareness of animal welfare on farms Arla gave producers nearly 18-months warning that from the 1st of January this year they may no longer euthanize any calves less than 8 weeks old, Arla will follow a “one strike and out” policy for anyone flouting the rules.

The UK average milk price for November 2020 was up to approx. 30.54ppl (AHDB).

Pigs

There have been reports of excessive delays at ports according to major pork processors, this is being driven by new paperwork requirements which are causing delays on shipments of the highly perishable product. The National Pig Association claims up to 30% of UK exports to the EU are being checked at the border, whereas the equivalent figure for imports to the EU from New Zealand is more like 1% the NPA says. This hold up has led to processors rejecting shipments and cancelling future orders (farming UK). This appears to be impacting the price of pigs at the farm gate, with the biggest decline in prices week-on-week since 2016 to 144.74p/kg deadweight, (this is still above the 5 year average however) – (AHDB).

FERTILISER & FUEL

Indicative fertiliser values are as follows: UK ammonium nitrate is currently priced at around £240/T, and urea is approx. £285/T Guide values for phosphate and potash are: Muriate of Potash (MOP) £250/T, Diammonium Phosphate (DAP) £370/T and Triple Super Phosphate (TSP) £270/T.

AHDB data reports red diesel was priced at an average of 51.51ppl for December 2020, while diesel at the pump was at 117ppl. This remains significantly below this time last year, as while the price of Crude oil is recovering it is still well below pre-pandemic prices.

COVID UPDATE

The new strain of Covid is spreading rapidly, and it appears that more people are asymptomatic with this one. It is sadly not surprising that the whole country is back in Lock-down after the slight relaxation of rules over Christmas, as the new strain runs riot through the population. Our thoughts are with everyone who has been directly affected by this disease.

The vaccines are being rolled out and some of our readers may already have received their first jab. We can only hope for swift progress with this programme.

The Government schemes for business support have been extended and are still open for applications. Some of these may close at the end of January, and if you have not previously applied for support you may still do so. Although agriculture is perhaps less affected than other industries, many farm businesses have had to close their diversified enterprises such as wedding venues, children’s play areas, cafes etc. The food and drink industry has also seen many changes in consumer demand for a wide range of products. There is no doubt that Covid had an enormous impact on many businesses.

The Government website makes it reasonably straightforward to find out what grants are available in each country, and there is a simple questionnaire to complete (turnover, number of employees, etc). The link is shown here; https://www.gov.uk/business-coronavirus-support-finder

Updates on the general rules can be found on the relevant government websites:

ENGLAND: https://www.gov.uk/coronavirus

SCOTLAND: https://www.gov.scot/publications/coronavirus-covid-19-what-you-can-and-cannot-do/pages/overview/

POLICY AND REGULATION NEWS

UK – EU Trade Deal

Prime Minister Boris Johnson’s news on Christmas Eve that he had struck a trade deal with the EU was meant to give him something of a Father Christmas status, and for lots of farmers and agricultural traders it did lead to a big sigh of relief. What does it mean for the UK’s farming industry though?

- Although trade for most goods (notably apart from seed-potatoes) is tariff-free between the UK and the EU, there will be a degree of friction where there was very little before – particularly from additional paperwork and boarder checks (the NFU claims this may add around 5 – 8% to export costs).

- Many of the farming commodity flows that had been hindered by the impending potential of a “no-deal scenario”, can now open up again, and there will be a kink in the graph for many of these flows as trading takes time to normalise again.

- Farming Industries that had suffered from chronic Brexit uncertainty in the last four and half years now have one more thing to rely on. This may prove to be a nudge factor to many farming developments and changes that have been waiting for this news.

- The UK’s farm support system is now completely independent from the EU’s Common Agricultural Policy and the UK’s four devolved administrations can begin implementing their own farm support payment policies.

- As a result of the UK’s independence of the EU’s regulatory standards, the UK can now explore new avenues in agricultural regulation. An example of this is George Eustace’s announcement at the Oxford Farming conference that DEFRA intends to carry out a consultation on the future of Gene-Editing in the UK. This might test the resolve of the EU regarding the new trade deal’s retaliatory measures regarding food production standards.

Read more of our analysis of these issues in articles and papers on the Rural Hub rural.struttandparker.com

Agriculture Act receives Royal Assent

This is a very significant piece of legislation and marks, according to Defra, an opportunity to move away from the EU’s bureaucratic Common Agricultural Policy and towards a system that increases productivity, is fairer and more flexible, particularly in terms of supporting environmental actions. The Act will be supported by a large number of statutory instruments, so it is not yet possible to assess what all of its effects will be. Its main features are:

- Support payments will change significantly. They will become more focussed on the objectives of the government’s 25 year Environment Plan.

- Greater transparency and fairness in the supply chain. The detail of these changes will be in statutory instruments but it is hard to see what additional powers government will have that it did not already.

- A duty to report to parliament on UK food security, which was a hard won addition to the Act by the farming sector.

- Trade, and in particular a Trade and Agriculture Commission which has a duty to report to parliament on the impact of any trade deals that the government wants to sign. We have previously reported on how effective, or not, this will be as it is historically very rare for MPs not to ratify a proposed agreement.

- Landlord and tenant changes, including for landlords to make investments on a let farm without it affecting rent reviews.

Of primary interest to farming clients in the short term will be:

- the detail of the new support schemes, including ELM, the Sustainable Farming Incentive and productivity grants

- the size and distribution of the overall budget and how it compares with the £3.2bn of spending in the UK

- how the new scheme(s) will interact with the phasing out of Basic Payments and the extent of the ‘funding gap’

Read our easy-to-read briefing on DEFRA’s ‘Path to Sustainable Farming’, published in December 2020.

Basic Payment Scheme calculators to help farmers plan for 2020-2028 subsidy changes

Our Farming Department has produced two tools to help you explore and understand what the change from Basic Payments to Environmental Land Management System (ELMS) and other support may mean for your business:

- Our 2020-2028 BPS calculator shows you how Basic Payments might reduce from 2020 to 2028.

- Our Farm support and ELMS calculator generates a bespoke, two-page report for any farm, on the effect on new profits of the change from BPS to ELMS as well as farming and diversification profits too.

Statutory minimum wage increases from 1st April 2021

The national living wage will increase to £8.91 per hour from £8.72 for workers aged 23 and above (which is a change from the current 25 years and above). The national minimum wage rates will also increase from 1st April:

- £8.36 per hour for 21 to 22 year olds (from £8.20)

- £6.56 per hour for 18 to 20 year olds (from £6.45)

- £4.62 per hour for 16 and 17 year olds (from £4.55)

- £4.30 per hour for apprentices (from £4.15)

Scotland’s Agri-Environment Climate Scheme (AECS) to reopen on 25th January on a restricted basis

It will be the first time that Scotland’s main agri-environment programme has been open to new applications since 2019. Applications will be restricted to funding for designated sites, organic farming, supporting farmland waders, corn buntings and corncrakes, along with actions to improve public access and slurry storage. The application period closes on 30th June.

FARM BUSINESS NEWS

Seasonal Workers Pilot expanded to allow farmers to hire up to 30,000 workers in 2021

This pilot scheme allows farming businesses to recruit a limited number of temporary migrants for specific seasonal roles in the horticultural sector. It is now managed by the Home Office under the T5 (Temporary Worker) Seasonal Worker immigration route. The change increases the number of workers that can be hired from the previous limit of 10,000. It will operate with four scheme operators (Concordia, Pro-Force and two new operators). The farming sector says that it requires around 70,000 seasonal workers so, although welcome, the increase will not meet demand. Businesses are already reporting that they are cutting production – partially and totally – due to the uncertainty, with some considering moving production overseas. The English Apples and Pears group said that ‘it’s beyond urgent’.

Cut to Annual Investment Allowance deferred for a year to boost investment in plant and machinery

This allowance gives businesses 100% tax relief on qualifying capital expenditure. The limit of the allowance was due to be cut to £200,000 a year but will be maintained at £1m until 31st December 2021.

British Woodlands Survey highlights need for more and quicker action on responding to environmental change

This survey is funded by the Forestry Commission and led by the always impressive Sylva Foundation, an environmental charity. The results are based on responses from just over 1,000 people, most of whom are woodland owners or agents. It found that if the sector is going to hit the targets set for it in The Forestry and Climate Change Action Plan much more action is needed – by both government agencies and woodland managers. Among four important management activities for adaptation, two were being adopted by the majority of woodland managers (reviewing tree species suitability and implementing continuous cover management), while two other actions (reviewing climate change projections and gaining understanding of soils) were not, which could undermine good decision making. One of the most challenging findings was that most respondents said that they did not intend to expand tree cover in the next five years, most often due to lack of available land but also frustration with the complexity of regulations relating to grant aid. All of the findings make it clear that it will be highly challenging to hit the UK’s targets for forestry.

Minimum size limit lowered to five hectares to be eligible for Woodland Creation Planning Grant

The minimum area of trees proposed to be planted has been lowered to five hectares from 10 hectares, in order to encourage more planting by improving the availability of grants for the planning phase. This is a small but positive change and we hope it encourages more farmers to think about planting small blocks of trees, which could help generate new profits from timber and carbon credits (both of which we expect to increase in the long-term). Woodlands can also improve the landscape, shoots and potentially increase farm capital values too.

Green Homes Grant Scheme funds £2 of every £3 spent on energy efficiency works up to £5,000 in England

This new scheme which offers up to £5,000 per property opened on 30th September and work must be done by 31st March 2022. The aim of the scheme is to enable homeowners and landlords to upgrade their homes and properties with energy-saving features, such as insulation or double glazing, in order to reduce energy usage and improve the energy efficiency of a property. Vouchers cover up to two thirds of the cost of specified home improvements up to a maximum of £5,000 for both primary and secondary measures. A voucher for 100% of the cost up to £10,000 is available for people on low incomes. The £2bn funding is expected to fund improvements in up to 600,000 homes, a large number, but we expect significant demand. The constraining factor appears to be the availability of accredited local suppliers (TrustMark registered or MCS certified businesses). Please contact Jess Waddington, Lauren Gibson-Green or your local building surveying team for advice on the grant and, most importantly, to ensure that any measures you are considering are appropriate and effective for your property. The Scottish Government has launched a new £4.5 million renewable heat scheme. 75% cashback up to £7,500 is available towards the cost of renewable heating systems and 40% cashback up to £6,000 for energy efficiency improvements; these can include wall insulation, gas connections, window glazing and insulated doors. Alternatives are available in Wales and Northern Ireland.