Updated BPS calculators to help farmers with business planning

Working out precisely how Basic Payments will change on your farm over the next few years – and whether the lump sum scheme is relevant to you – are important business planning exercises.

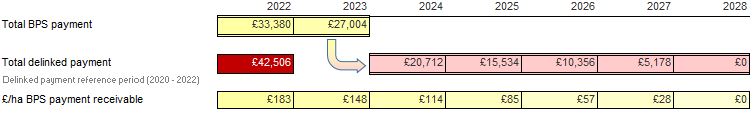

We have updated our Basic Payments calculator, which shows how they will change over the agricultural transition period (2021 to 2028). It now includes all three elements of the changes to Basic Payments – the reduction in payments, delinking and the lump sum exit scheme.

The reduction in Basic Payments

Basic Payments have been a very important element of profits for many farms for many years, so understanding how they are going to reduce between now and 2027 is important for planning how your farm business could respond.

The payments started to be cut in 2021/22 but the cuts were small. 2022/23 is the first year of significant cuts – of 20-25% for smaller farms and 35-40% for larger ones – but we think that a key year to focus on is 2024/25, which is when Basic Payments will have halved from their original levels and also when most of the new schemes – ELM and others – should be in full operation across England.

As the cuts are applied in brackets, like income tax, the calculations can get complicated hence why we produced our calculator.

For example, for a 250 hectare lowland farm, this year’s Basic Payment Scheme (BPS) payment will be 25% less than before the cuts started (at £178/ha compared with £236/ha in 2020); in 2024/25, it will be 54% less than the original level (£108/ha).

For a smaller 125 hectare farm, the reduction is smaller (21% or £187/ha compared with £236/ha in 2020), as the policy is to apply larger cuts to larger farm businesses in the early years of the transition. In 2024/25, the BPS payment will be 50% of the original level (£117/ha).

Delinking

The calculator also takes into account delinking, which means that farmers will no longer need to physically farm any land in order to claim Basic Payments from 2024 onwards. Instead, they will receive payments based on what they farmed in a three-year reference period from 2020/21 to 2022/23. This means that getting this year’s Basic Payment claim right is important for maximising the delinked payments in the future.

The purpose of breaking the link between the payments and the land is to encourage changes in ownership and tenure and how the land is farmed – to speed up the changes by removing any constraints that having to physically farms the land might have created.

Lump sum exit scheme

Another change to speed up changes in ownership and tenure is the ability to get future Basic Payments in one ‘lump sum’. Consider it like an advance payment (with penalties) rather than an additional payment.

It is calculated based on 2.35 times the 2019/20 – 2021/22 average BPS payment, up to a maximum of £100,000. The cap means that it is mainly going to appeal to farmers with smaller holdings – any farm above 182 hectares would have received a lump sum of more than £100,000 so this is around the threshold where this policy could be attractive.

We are finding that the policy has started more conversations between landlords and tenants, and on owner-occupied farms, about retirement and planning for the future, which means it has had some effect.

However, it is unlikely to lead to large-scale changes. Only 19% of 700 farmers questioned by the University of Exeter in England, Scotland and Northern Ireland said that they planned to retire fully, with most continuing to work as farming as their vocation. It is the cuts to Basic Payments that are likely to have much greater effects, especially as they are happening at the same time as massive changes in crop and fertiliser prices.

Business planning

Using the calculator to assess how Basic Payments will change on your farm is a useful starting point when it comes to business planning.

We have also produced another calculator that calculates total farm profits – not just from Basic Payments but also from farming, agri-environment and diversification. Its value is that it gives a more complete picture and shows how much profits from the other sources will need to change to maintain overall levels of profits.

Contact your local farming team or email rural.enquiries@struttandparker.com if you would like them to run your farm through the calculators. They can also offer free business advice, funded by the government, through the Farm Resilience Fund.