Q & A on EPC rules for non-domestic property

Farms and estates which have diversified by letting out commercial property such as office space and retail units must ensure they are compliant with revised energy efficiency rules which came into effect on 1 April 2023.

What has changed?

The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 set out the minimum level of energy efficiency in non-domestic properties in England and Wales.

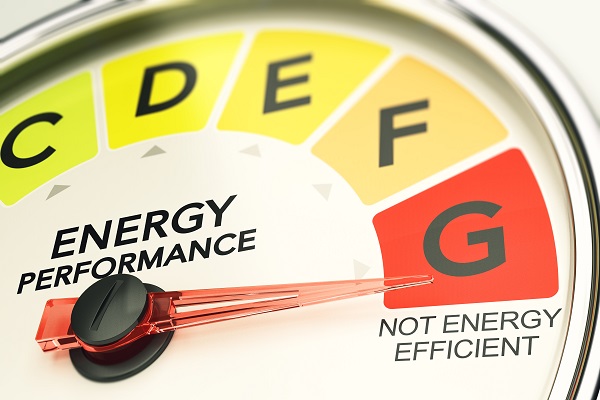

Since 2018 it has been unlawful to grant a new tenancy, including renewing an agreement, unless the property has an Energy Performance Certificate (EPC) rating of E or above.

However, the rules tightened from 1 April 2023, so landlords can only continue to let a commercial property if that property meets the minimum E rating.

If the property currently has an EPC of F or G, then the landlord is required to install energy efficiency measures to raise the rating to an E, or they may, in certain circumstances, apply for an exemption from the rules.

The government has also proposed that from 1 April 2027 it will be unlawful to let any non-domestic property if it has an EPC lower than a C, rising to B by 1 April 2030.

Who is affected in the rural sector?

Some buildings typically let by farm and estate owners may fall outside of the legislation.

The rules only apply to non-domestic property which is legally required to have an EPC, so buildings which are exempt from an EPC, such as industrial sites, workshops, and non-residential agricultural buildings with low energy demand, fall outside the scope of the rules.

A general rule of thumb is that if the building does not have any heating or cooling system then an EPC is not required (except in buildings where there would be an expectation of heating).

Property types which could fall under the scope of the regulations include farm buildings that have been converted into offices, retail space, studios, show rooms and gyms.

The situation is slightly less clear cut with farm-based holiday accommodation. Government guidance is that an EPC is only required if the guest is responsible for paying the energy bills and most holiday-home owners will be picking these bills up. However, it is possible to argue that the guest indirectly pays the energy costs as part of their rental fee. The safest option is to contact Trading Standards who are responsible for enforcing the legislation to clarify if an EPC is needed or not.

What action is required?

Landlords who have a building with an F or G rating will need to take action quickly, or investigate whether they qualify for an exemption.

Installing low-energy lighting, draught-excluder strips around doors and insulation can be easy wins in terms of raising a property’s rating. Other possible solutions include replacing single-glazed windows with double-glazing and upgrading any electrical heating systems to a more efficient model.

More involved works, such as internal wall insulation or the retrospective introduction of below floor insulation can result in a greater increase on the EPC scoring. However, advice on the suitability of improvement measures should always be taken before entering a construction contract to make sure a holistic view is taken.

In addition, some rural landlords are looking at installing renewable energy electricity and heating systems, both to improve the EPC and to give tenants the opportunity to buy electricity at a cheaper rate than they are likely to be currently paying.

Is grant support available?

The Boiler Upgrade Scheme provides grants to cover part of the cost of replacing fossil fuel heating systems with a heat pump or biomass boiler. It can also be worth investigating with the local council if it has any energy efficiency funding available to businesses.

Are there any exemptions?

There are a number of exemptions which may apply for landlords and allow them to keep letting a property which does not meet the minimum E rating. They include:

Seven-year payback test: The ban on letting non-domestic property below an E rating does not apply if a landlord can show that the cost of purchasing and installing a recommended improvement or improvements does not meet a simple seven-year payback test.

Third-party consent: This could apply if improvements cannot be made because consent cannot be obtained from the current tenant of the property or if other third parties, such as the local authority, refuse planning permission for improvements.

Devaluation exemption: Applies where there is evidence that the installation of a relevant measures would devalue the property by more than 5%.

New landlord: New landlords can apply for an exemption for six months.

Any exemptions must be registered on the PRS Exemptions Register. After five years the exemption will expire and the landlord will be required to try to improve the property to meet the minimum standard, or register another valid exemption.

What happens if there is a breach of the rules?

A landlord letting a non-compliant building could be fined up to £150,000 and anyone found to have submitted false information to the PRS Exemptions Register risks a financial penalty of up to £5,000.

Final thoughts?

High energy prices mean tenants are far more conscious of energy consumption than they used to be, so raising standards should help to make the property more lettable.

If work needs to be carried out part way through a tenancy, it is always advisable to engage with the tenant as early as possible, so plans can be put in place to minimise any disturbance. Given any works should result in a reduction in running costs, most tenants should be supportive.

While it has not been officially confirmed by the government that an EPC of B will be required by 2030, the consensus within industry is that some tightening of the rules is highly likely. With this in mind, it may be sensible to put in place 10-year maintenance plans for any commercial property on the farm, so any works can be programmed in to spread the cost.

Finally, all of the High Street banks now have net-zero targets and so are becoming less keen to lend against properties that are not energy efficient. Farmers looking to refinance and using property as security are likely to be offered better rates if they can prove a building is energy efficient.

A version of this article appeared in 31 March, 2023 edition of Farmers Weekly. For more on the definite and expected changes to MEES rules – covering domestic and non-domestic property – read our quick guide.