Scottish Farming Update – Autumn 2020

Welcome to this quarter’s Farming Update, which is produced by our Farming Research Group and reports on market and administrative issues that affect farmers’ business decisions and on which they may need to act.

MARKET UPDATE

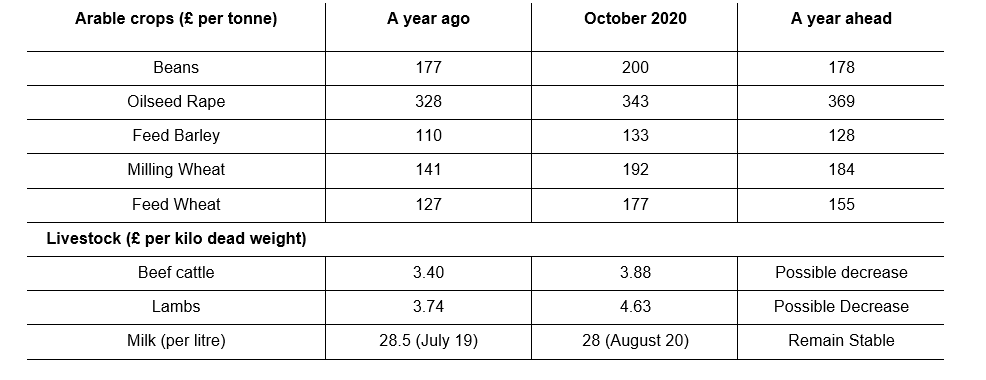

ARABLE CROPS

Global: Grain Production Report

The FAO – (the Food and Agriculture Organisation of the UN), are predicting, in spite of uncertainties brought by the Coronavirus pandemic, that the global supply and demand of cereal grains will increase this year. Production is set to beat last year’s record by 1.7%. Demand is also set to increase (mainly lead by higher consumption of maize products by livestock), but not in pace with production, leading to growing global stocks to around 895.5 Million tonnes. Notably it is estimated that 47% of this stock is held in China.

The positive predictions for global cereal production are driven by foreseeable record harvests in Canada, and record-high predictions for Brazil and Argentina. Maize production is driving this growth, and this will outweigh lower wheat production following difficult growing conditions in the EU and elsewhere in the Northern Hemisphere such as Ukraine.

On a positive note for Global Wheat productivity, Guinness World Records has verified a new world record for wheat yield, south of Christchurch in New Zealand at 17.398 Tonnes per hectare. Jealous British farmers should note that this crop was grown on irrigated land, and the average yield for that area is already an impressive 12 Tonnes per hectare. Something to work towards though!

UK MARKETS

Wheat

UK Wheat harvest saw a 15% yield reduction per ha from the 5-year average according to the UK Centre for Ecology and Hydrology, who also found that this is in combination with a 44% reduction in the winter wheat area from the 5-year average. The quality of wheat seemed to have been good, (which is to be expected from a low yielding crop), that is up until the rain in Autumn when harvest progress was hampered and the wheat arriving later in store seems to have had a lower quality with problems such as sprouting and poor hagberg falling numbers (FWi).

Even before the news arrived that the crop diversification rule under the “greening” element of the basic payment scheme has been dropped by SGRPID, the drilled area of Winter Wheat for the next harvest was likely to be large. It is likely to be even greater now, particularly if good weather prevails through the autumn. The news will likely lead to a fall in wheat futures for Autumn 2021 (November 2021 prices are at £153/T, whereas November 2020 prices are at around £180/T). As such farmers would be advised consider selling forward a proportion of their expected crop at these levels.

Barley

Winter barley suffered a similar fate to winter wheats across the UK. With less than 45% of the planted area in good or excellent condition, the AHDB estimated that national yield was well below the 5-year average. Due to poor tillering, the nitrogen contents of some winter malting barley crops have been high (reaching above 2% in the East of England), meaning that very little achieved malting specification. AHDB’s yield estimates for winter barley are at 6.5T/ha – 6.7T/ha, compared with 5-year average of 7.1T.

Spring Barley, as a cropping option, mopped up much of the area this spring which had previously been intended for winter crops in England, increasing the UK total for 2020 significantly. The AHDB’s predicted increase of 29% from 2019 on national production is not reflective of outstanding yields, but simply a larger area. AHDB’s UK yield estimates for Spring Barley are at 5.7T/ha – 6.1T/ha compared with 5 year average of 5.8T.We expected higher grain nitrogen to be a big issue this harvest, after the prolonged dry spring, but this was not as much of a problem as anticipated. Skinning did cause some rejections, but across the whole of Scotland the spring barley crop was a lot better than expected.

Oilseed Rape and Others

United Oilseeds are estimating the national crop area in 2020 to have been as low as 320,000ha, and with average yields ranging from 2.6 – 3.0t/ha. This would give a crop of under 1m tonnes – less than half that of two years ago.

With the usual cocktail of pests and weather hampering the potential of the OSR crop, there appears to be a trend of English farmers moving away from their old three crop rotations to give oilseed rape as long a break as possible. Other crops are finding their way back into the rotation such as linseed and beans. Scottish growers are seeing the benefit of this, with good prices and manageable levels of pest damage north of the Border.

UK 2021 CROP DRILLING CONSIDERATIONS

As mentioned above there is expected to be a larger than average winter wheat area drilled this autumn. Soil conditions in the last few weeks have been ideal and the crops sown so far have gone into perfect seedbeds and have been rolled. Many have received the autumn herbicide, and those who wait till they can see the tramlines are optimistic of getting everything sprayed before the winter closes in. Many growers failed to get autumn sprays on last year, and this certainly compounded severe weed control challenges of 2020.

The long-drawn-out harvest meant that rape could not be sown particularly early but most crops are off to a good start and, unlike last year, autumn herbicide applications have not been omitted. There has been more flea beetle damage than usual but as stated above, all at tolerable and manageable levels.

LIVESTOCK

Beef and cattle

When the UK went into lockdown the inevitable closing of pubs and restaurants lead to a drop in demand for beef products, and only when the market responded to a heightened demand for beef mince (for home cooking) did the lockdown shock begin to subside.

The beef price had been recovering from very low prices in 2019 and at the beginning of 2020 the outlook was fairly positive, the lockdown initially put that into reverse, but the bounce back pushed prices up above the 5 – year average. This uptick was supported by the easing of lockdown measures that allowed people to enjoy the excellent Barbeque weather.

Since the height of summer, when the ‘eat-out-to-help-out’ scheme was in force, and peak BBQ season was in flow, beef prices have fallen.

In the longer term however there is no certainty about when the food service industry will be operating at capacity again. With a potential second lockdown (albeit less severe than the first), and with indications that the Irish beef industry is picking up pace there is not much reason to be optimistic about the beef price going into the autumn.

Lambs and sheep

Being seen as a luxury by most households, lamb prices initially suffered from the lockdown, partly due to the food service industry’s pause and slow recovery, but also due to the perception of being a less versatile meat, and where beef mince has won out lamb mince hasn’t fared so well. Added to that one of the mainstays of the lamb annual price cycle are the Islamic feasts which have been subdued affairs this year due to social distancing rules.

Since lockdown eased back in the spring the barbeque effect and eat-out-to-help-out helped prices somewhat. Through the summer however the AHDB have observed roasting joints of lamb become more popular in UK households and the volume of lamb per buyer has increased by 5% on last year – this is great news for lamb producers and marketers who have been trying, for a long time, to reverse the trend of declining supermarket sales.

The longer term outlook for Lamb is a mixed picture, the uncertainty of the Covid-19 situation and Brexit provide little to build a future price consensus on, but both a slowdown in imports from New Zealand and a slowdown in UK production may help support the price somewhat.

Dairy

The struggles of the dairy sector were well reported during the spring, and we all heard the tales of milk being tipped straight out of the parlour into the drain. The government put in place the Dairy Hardship Fund which partly addressed the issue of very poor milk prices from some processors. The differences between the milk processing companies were laid bare as the destination of their milk (supermarket vs. hospitality sector) was the difference between healthy milk prices or a total collapse in demand. Some of this disparity will have been addressed by the re-opening of cafes, restaurants and the eat-out-to-help-out scheme.

The AHDB predicts milk production to pick up this autumn as the autumn calving herds boost numbers back up to normal (many spring calving cows will have been dried off early this year for a combination of factors) feed prices and silage quality fears have been allayed by a good August for grass growth and massive national production of feed barley to provide relatively cheap rations.

The UK average milk price for August 2020 was up to approx. 28ppl but there is great variation in contract price within that. Indeed if the average of supply contracts for Scottish producers is taken, it is likely to be in the region of 24-25ppl.

As with all UK produced commodities Covid-19 has not replaced Brexit as the source of uncertainty it has simply been placed on-top of the stack of destabilising market factors. The future of the dairy market depends on milk processors diversifying their product range and their global export reach.

Dairy Contracts Reform Negotiations

The consultation phase of the Dairy Contracts Reform has now closed. Proposals put forward include an option to introduce fairer pricing mechanisms for dairy farmers ensuring the price paid for milk produced by the farmer is formally agreed in a clear and transparent way.

FERTILISER & FUEL

UK ammonium nitrate is currently priced at around £207/T, and urea is approx. £244/T Guide values for phosphate and potash are: Muriate of Potash (MOP) £248/T, Diammonium Phosphate (DAP) £307/T and Triple Super Phosphate (TSP) £251/T. (all Farmers weekly prices last updated in July 2020).

AHDB data reports red diesel priced at an average of 51.52ppl for August 2020, while diesel at the pump was at 118ppl. This remains significantly below this time last year, due to the coronavirus induced drop in global demand.

POLICY AND REGULATION NEWS

Basic Payment Scheme

The “greening” rules have been relaxed slightly with the removal of the three crop rule for 2021 onwards However, whilst DEFRA have gone a step further by scrapping the entire greening system south of the border, The Scottish Government have elected to continue with the current Ecological Focus Area (EFA) rules.

Sustainable Agriculture Capital Grant Scheme (SACGS)

The Scottish Government launched the SACGS at the beginning of September with very little lead in. The pilot scheme offers up to £20k of funding for investment in technology and equipment that are deemed to reduce the carbon footprint of farm businesses by increasing efficiency.

The pilot scheme offers 50% funding (or 60% for businesses located in the Highlands and Islands) on a pre-determined list of equipment applicable to arable and livestock sectors. The process of applying to the scheme is very straight forward and with standard costs allocated to each item of equipment, no quotes are required.

Uptake is likely to be very strong meaning that competition for funding will be fierce. It is not clear how he the scoring process will work but extra ‘points’ can be gained if a carbon audit and/or heath plan and/or nutrient management plan carried out prior to the 1st of March 2020 and after the 31st of March 2017 support investment in the relevant item(s) of equipment. An application deadline of the 11th of October has been set.

ILMP Funding Continuing until October 2021

The Scottish Government have confirmed that funding for the completion of Integrated Land Management Plans will continue for another 12 months. Through the scheme, farm and rural land based businesses can access up to £1,200 of funding to complete a business review. Further funding can then be accessed to follow up on any recommendations that are made within the initial ILMP.

FARM BUSINESS NEWS

Strutt & Parker in natural capital account collaboration with eftec

Strutt & Parker is delighted to announce a collaboration with leading environmental economists Economics for the Environment Consultancy (eftec) to help rural landowners enhance and unlock the potential of their natural capital assets.

Strutt & Parker worked with eftec last year to produce one of the first natural capital accounts of its kind for a large private estate in Yorkshire with multiple land uses. This was a significant piece of work which demonstrated how investment in natural capital and low carbon thinking can be compatible with a thriving business plan, and is now being used as a tool to aid decision making on the estate.

Natural capital accounting is a way of measuring, monitoring and valuing a farm or estate’s natural capital assets, presenting the information in a similar way to a set of financial accounts.

Find out more by reading Measuring the value of the natural capital on a Yorkshire estate

Carbon Accounting

With climate change rising rapidly up the government’s agenda, it will become increasingly important for landowners to show how they are taking action to reduce emissions and increase carbon sequestration.

Carbon accounting is the principle way to do this and it is expected to form a major part of future agriculture policy, possibly becoming mandatory for farm businesses, either through regulation or as part of meeting farm assurance obligations.

In Scotland, it is starting to form an increasingly important part of the agricultural policy framework. Grant funding worth £500 is already available from the Farm Advisory Service to pay for an accredited adviser to carry out a carbon audit and having such an audit is a requirement of the Beef Efficiency Scheme (BES). Meanwhile, the pilot Sustainable Agriculture Capital Grant Scheme, which provides grants for farmers in Scotland to buy capital equipment that will reduce emissions, offers bonus ‘green points’ to applicants who had previously carried out a carbon audit.

There are a number of free carbon calculators available, which means anyone can pursue carbon accounting. However, the challenge is what to do with the results. Our experts can highlight areas where GHG emission are higher than expected and help mitigated this by introducing low carbon farming techniques. This in turn with help the business become more sustainable and cost efficient.

Contract Farming Agreement survey published for harvest 2019

Total income to the farmer averaged £392/ha and income to the contractor was £395/ha – both above the five-year average. The survey is based on the results of 76 agreements covering more than 20,000 hectares. Our publication also includes our thoughts on how this contract farming agreements will have to become more flexible in response to changes in government support and the introduction of more environmental measures into most arable rotations.

COVID-19 UPDATE

It is clear that Covid-19 will be here for some time to come, at least until a vaccination is developed, and it continues to impose a heavy impact on society and the economy. As alluded to above, the reduction in hospitality events and outlets has greatly reduced demand for milk and meat in particular, but the brewing and malting sectors have also been hit. Rapid changes in the rules regarding social gatherings (and therefore food and drink consumption) make it virtually impossible to plan ahead, and the likelihood is that cases will increase through the winter months.

In most situations the restrictions on work are less severe than on social meetings, but it is important for employers to keep up to date with regulations and guidelines, and to communicate with staff regarding any health issues.

The Chancellor, Rishi Sunak, has announced measures to provide further financial support for businesses including the self-employed, and VAT reductions for the hospitality and tourism sectors, which may benefit farm diversification enterprises. The package includes a Job Support Scheme and longer repayment terms for Bounce-Back loans. For further details follow the link:

https://www.gov.uk/government/news/chancellor-outlines-winter-economy-plan

Updates on the general rules can be found on the relevant government websites:

SCOTLAND: https://www.gov.scot/publications/coronavirus-covid-19-what-you-can-and-cannot-do/pages/overview/